Board gamers in “tough” US market turning to lower priced games, Asmodee CEO says, as company unveils another quarter of soaring sales

Economic uncertainty in the US is driving people towards lower-priced games, Asmodee CEO Thomas Koegler said, as his company revealed sales of more than €400m in the last quarter – up more than 20% on the same period last year.

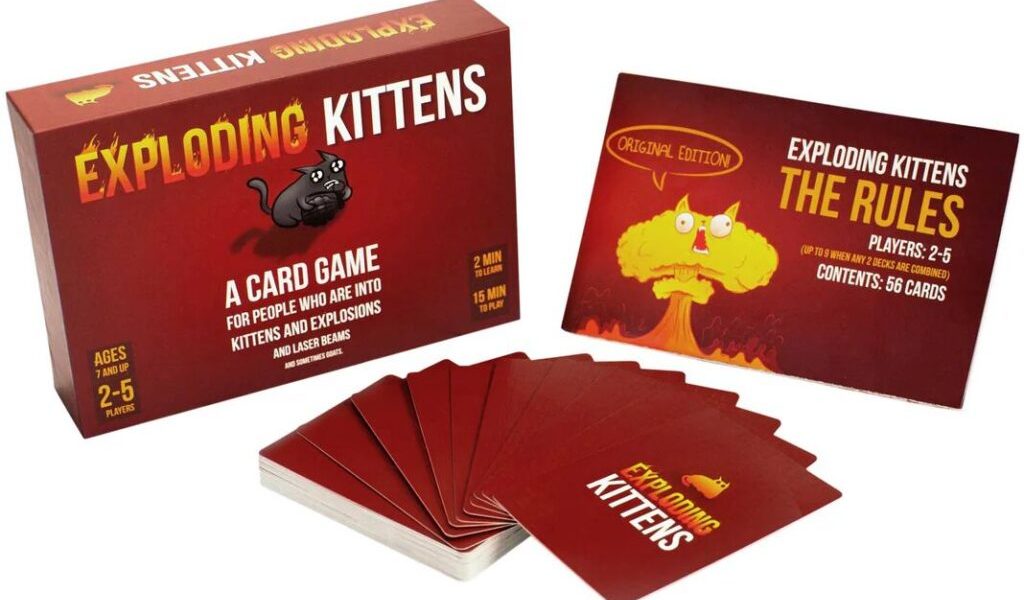

Koegler said Asmodee had seen “good momentum” in its lower price-point products in the US mass market, singling out Exploding Kittens as a particularly strong performer in what he called a “challenging market”.

Speaking on an investor call for the company’s Q2 results – which cover July to September – Koegler said, “In the US its mainly driven by the fact that consumers are delaying their purchases ahead of Christmas – I think what we see is that it’s later and later in the year.

“Some retailers have also postponed putting in their Christmas aisles, which did impact Q2. And lastly consumers currently – again, its in a period where it’s not yet the gifting period, or the Christmas period – have favoured in Q2 more lower price point products given, I would say, the economical[sic] uncertainty on the American market, employment market and everything else.”

Koegler said the European market, meanwhile, continued to grow across both board game and trading card games – although he added that its Germany operation had experienced some “softness” due to its Blackfire TCG distribution arm receiving lower allocations of products than it had in the past.

Asmodee recorded “strong performance” in Germany across its board game and Gamegenic accessories operations, however, with Koegler adding the Blackfire performance was “nothing to worry about”.

The company’s overall €403m of net sales between July and September marked its fourth quarterly year-on-year rise in a row, with Koegler saying strong performance from Exploding Kittens and other Asmodee lines such as Catan, Ticket to Ride and Dobble/Spot It had helped drive the result.

Despite the strong sales performance Asmodee recorded a €6.2m loss in Q2, compared to a profit of almost €8.2m in the same period last year.

Asmodee said that loss was partly down to the improved current and expected performance of Exploding Kittens, given that it expects to exercise its right to buy the remaining minority stake in the business it does not already own in the first half of next year.

The board game publishing and distribution heavyweight has seen its sales rise to more than €1.5bn across the last four quarters – up on both the €1.36bn it recorded for the last financial year, and €1.2bn for the prior financial year ending on March 31 last year.

M&A strategy “not just snatching distressed assets”

Asmodee revealed last November that its growth plans in the wake of its split from its former owner Embracer Group earlier this year would include “reigniting” its strategy of buying up smaller board game publishers and distributors, mirroring the explosive growth the company undertook after being bought by private equity firm Eurazeo in 2014.

Its previous buying spree saw it acquire more than 40 companies and IPs, including over 20 game studios such as Days of Wonder, Fantasy Flight Games, Lookout Games, Catan Studio and Z-Man Games.

Koegler said 12 months ago that the company had a pipeline of more than 20 acquisition opportunities – but a year later its M&A activity has so far been limited to the IP purchases of Zombicide and Cthulhu: Death May Die from financially troubled board game publisher CMON.

Speaking on the latest earnings call, Koegler said, “I would say there is a context that enabled us to do the deals with those first two IPs – and they are IP deals so they are by essence a bit faster to execute than when were are looking at buying full studios.

“On the rest I would say that there are product categories that are quite successful, and when there are successful categories you have some studio owners that are thinking about what are their ways of growing faster, whats the next step in their evolution?

“So we have active discussions, but as we said in the past were not commenting individually. There is a healthy pipeline of opportunities we’re actively working on.”

He added that while recent economic volatility around US tariffs had inevitably created greater acquisition possibilities, echoing comments he made in March, Asmodee’s strategy had to be more than just opportunistic buyouts of struggling businesses.

Koegler said, “It’s true that some smaller publishers, or publishers that have more limited financial means than us, have seen some struggle – maybe less from the market, and more from the tariff impact that they’ve faced given their exposure to the US market.

“So will there be opportunities linked to that? Probably – but in the end, as we always said, the way we conduct M&A is project, timing and valuation – so there has to be a project, not just being opportunistic, snatching distressed assets. That’s not the way we operate, we acquire because we see potential.”

Crowdfunding push

Asmodee’s acquisition of Zombicide and Cthulhu: Death May Die are part of the company’s push into the crowdfunding space, an area it has previously barely touched through any of its myriad studios.

BoardGameWire revealed in June that the company had brought in David Preti, the recently-resigned COO of CMON, in a newly-created role to head up its crowdfunding and miniatures strategy.

More details about that strategy were unveiled by Asmodee at Pax Unplugged last weekend, during its subsidiary studio Fantasy Flight Games’ annual “In-Flight Report” showcasing its upcoming titles for the year ahead.

FFG’s director of board games, Caitlyn McGrath, confirmed during the presentation that Zombicide and Cthulhu Death May Die would come under the FFG brand, while the studio would also look to run crowdfunding projects for some of its older, out of print and hard to find titles under a strategy called FFG Vault.

She said the rejuvenated, crowdfunded titles would keep their existing mechanics, but would feature updated art and graphic design, greater quality control and improved and updated rulebooks.

McGrath said, “For the most part you can consider the Vault series like ultimate or collector’s editions of these games.”

FFG revealed during the presentation that it would be launching a crowdfund “soon” for standalone game Fantasy Zombicide: Dead Men Tales, and would be releasing a Squid Game-themed expansions for Zombicide second edition next summer.

The company has not specified which crowdfunding platform will be used for its forthcoming campaigns. Although Kickstarter retained the lead in pure dollars raised over rival Gamefound last year, the gap continues to narrow – and Gamefound has increasingly become the home for campaigns which include large amount of plastic miniatures.

While at CMON Preti oversaw the company’s switch from Kickstarter to Gamefound in early 2024, ending 12 years of running almost 60 campaigns on the platform worth a combined $108m.

Koegler said of Asmodee’s new crowdfunding strategy during the latest earnings call, “The reasons behind the crowdfunding strategy is that some products in the way they are structured could probably not exist only through retail, that’s both linked to their margin structure but also because crowdfunding is actually a very strong consumer engagement way of launching the product.

“It drives demand, it creates excitement and it’s really a way of interacting with the consumers in a digital way that is quite different from traditional product launches.

“So for us its complementary to the other product lines that are launched in the more traditional way. It’s true that with games with a lot of miniatures, board games with a lot of miniatures, this model has been seen in the past as quite successful.

“Talking about the opportunities – I will not comment on the performance or the struggles that some partners are facing. What is clear is that Asmodee – and we have demonstrated over the past decade – can be home to many more studios and intellectual property, and if the timing is right it’s a good moment to join the Asmodee family.”

Koegler also highlighted the recent media deals done by the company, which include last month’s announcement that Catan would be coming to Netflix in the form of both “scripted and unscripted projects”.

He said, “The media deals we do, we do them less for the revenue that they provide, although its always still interesting, but more for the exposure that it provides to the brands.

“Just an element of comparison, what we communicated on a year ago when the first season of the Werewolves TV show on Canal+ aired, we saw a very significant increase in sell out for the brand [The Werewolves of Miller’s Hollow] in the mass market.

“So that’s what we’re striving for – it’s more the impact on sales of physical products, rather than at the level of the deals that we have today, the royalties.”

The post Board gamers in “tough” US market turning to lower priced games, Asmodee CEO says, as company unveils another quarter of soaring sales first appeared on .